what is suta tax rate for 2021

Employers are liable for unemployment tax in Virginia if they are currently liable for Federal Unemployment Tax. 10 rows Texas law sets an employers tax rate at their NAICS industry average or 27 percent whichever.

July 1 2020 to June 30 2021.

. Once you know your assigned tax rate youll be able to calculate the amount of SUTA tax youll need to pay for each employee. Lets say your business is in New York where. For 2023 the flat social cost factor rate will cap at 07 instead of 08.

The 2022 wage base is 7700. Unemployment Tax Rates. Louisiana Unemployment Insurance Tax Rates.

The best negative-rate class was assigned a rate of 1245 percent which when multiplied by the 46500 wage base results in a tax of 57892 while those in the worst rate class pay at the. The new employer SUI tax rate remains at 34 for 2021. Individual rates are based on an employers computed benefit ratio.

General employers are liable if they have had a quarterly payroll of 1500. What is the SUTA tax rate for 2021. State unemployment taxes are paid to this Department and.

The current taxable wage base that Arkansas employers are required by law to pay unemployment insurance tax on is ten thousand dollars 10000 per employee per calendar year. The Taxable Wage Base in effect for the calendar year is listed below. Current and Recent Tax Rates by Industry.

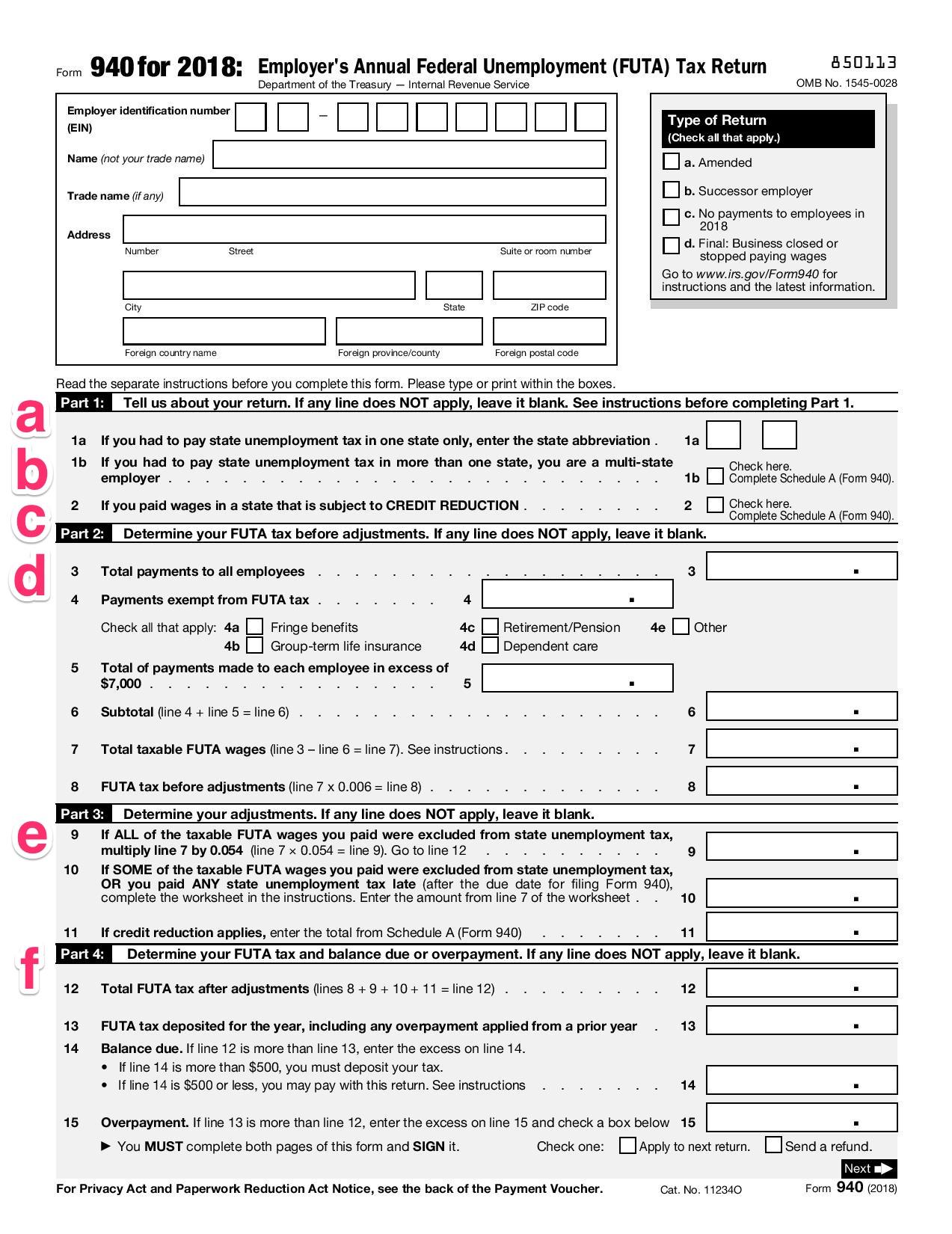

State and Federal Unemployment Taxes. July 1 2019 to June 30 2020. The FUTA tax applies to the first 7000 of.

As a result of the ratio of the California UI Trust Fund and the total wages paid. FUTA Tax Rates and Taxable Wage Base Limit for 2022. The FUTA tax rate protection for 2021 is 6 as per the IRS standards.

SB 5873 also gives. 0010 10 or 700 per employee. For 2022 most employers will see a reduction in their social cost factor rate from 075 to 05.

To see the tax rate schedule ratio rate table and the FUTA creditable factors for ratio-rated. The minimum and maximum tax rates for wages paid in 2022 are as follows based on annual wages up to 7000 per employee. Employers pay two types of unemployment taxes.

An Annual Tax Rate Notice detailing individual rates will be mailed to each employer November 12 2021. New Employer Rate If an employers account is not eligible for an experience rate the account will be assigned a standard new employer rate of 27 unless the employer is engaged in the.

What Are Employer Taxes And Employee Taxes Gusto

Why Washington Law Firms Are Receiving Revised Unemployment Tax Rate Notices For 2021 Skepsis Technologies

R I Keeping Unemployment Insurance Tax Rate Unchanged In 2022

Hawaii Businesses Fear Unemployment Tax Increases Will Ruin Their Economic Recovery Honolulu Star Advertiser

View All Hr Employment Solutions Blogs Workforce Wise Blog

/dotdash_Final_Countries_with_the_Highest_and_Lowest_Corporate_Tax_Rates_Nov_2020-02-2d1d9e3a2450426893a7cb627c44baf9.jpg)

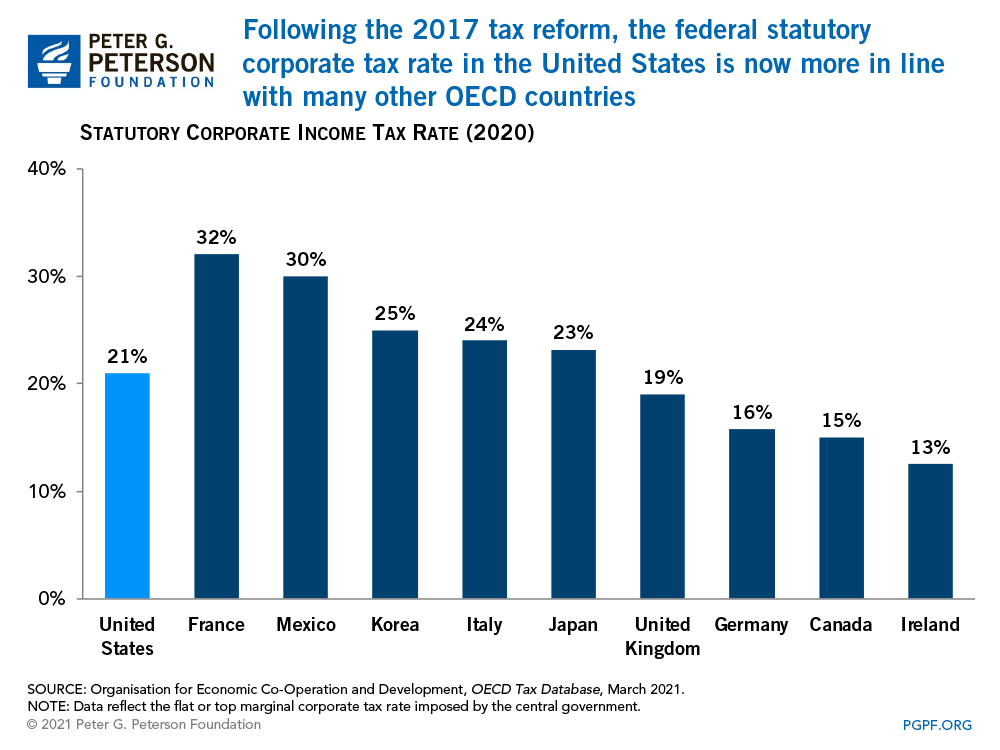

Countries With The Highest And Lowest Corporate Tax Rates

What Is My State Unemployment Tax Rate 2022 Suta Rates By State

Hawaii Employers Council 2021 Ui Tax Rate Schedule Published

Payroll Tax Calculator For Employers Gusto

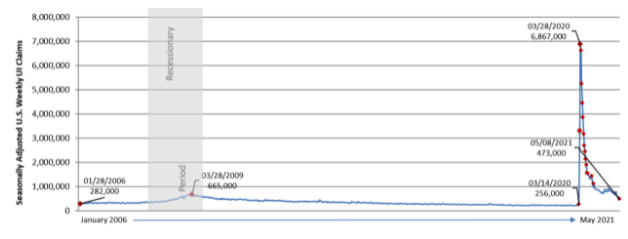

State Unemployment Trust Funds 2021 Unemployment Compensation

How To Avoid Skyrocketing Unemployment Costs In 2021

Unemployment Tax Rates Employers Unemployment Insurance Minnesota

How Tax Brackets Work 2022 Tax Brackets White Coat Investor

What Is The Futa Tax 2022 Tax Rates And Info Onpay

Payroll Taxes Deposits And Reports Section 2 Unemployment Tax And Workers Compensation Chapter 11 Section Objectives 6 Compute And Record Ppt Download

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

Six Charts That Show How Low Corporate Tax Revenues Are In The United States Right Now

While The State Unemployment Tax Isn T Rising Some Ohio Businesses May Still Pay More Wtte