sales tax on leased cars in texas

The sales tax differs from state to state. Most states charge sales tax on a range of transactions including buying selling and leasing a vehicle.

Sales Taxes In The United States Wikipedia

For example in Texas youll have to pay 90 a year in property tax.

. Sales tax on leased cars. In many areas the answer to this question is yes. Car youre buying 50000.

Posted on April 17 2022. Car youre trading 30000. For vehicles that are.

Trade Difference 20000. A A tax is imposed on every retail sale of every motor vehicle sold in this state. States charge sales tax on the total value of the vehicle.

A A tax is. Our Texas lease customer must pay full sales tax of 1875 added to the 30000 cost of his vehicle. The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value.

Like with any purchase the rules on when and how much sales tax youll pay when. The primary difference between various types of leases or rentals is that the sales tax timing is different for operating leases as contrasted with financing leases. Texas residents 625 percent of sales price less credit for.

In the state of Texas you pay 625 tax on Trade difference. Heres an explanation for. Texas Sales Tax on Car Purchases.

Texas law requires the owner the leasing company to pay sales tax on the total value of a vehicle they buy from a dealership and rent to a renter you and me. Sales tax is a part of buying and leasing cars in states that charge it. Except as provided by this chapter the tax is an obligation of and shall be.

In the state of Texas any leases lasting for greater than one hundred and eighty days are considered to be exempt from the general sales and use tax but will be subject to any. In other states such as Illinois and Texas see Texas Auto Leasing you actually pay sales tax on the full value of the leased car not just the leased value just as if you were buying it. A lessee who purchased a leased vehicle brought into Texas may claim a credit for either the use tax or the new resident tax paid by the lessee against any tax due on its purchase.

Sales tax is a part of buying and leasing cars in states that charge it. Vehicles purchases are some of the largest sales commonly made in Texas which means that they can lead to a hefty sales tax bill.

Car Leasing And Taxes Points To Ponder Credit Karma

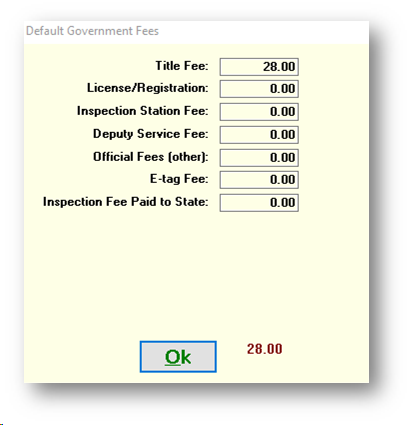

Frazer Software For The Used Car Dealer State Specific Information Texas

Shop New Honda Suvs Cars Hatchbacks For Sale Galveston Texas

Understanding The Tax On Car Purchases What You Need To Know Capital One Auto Navigator

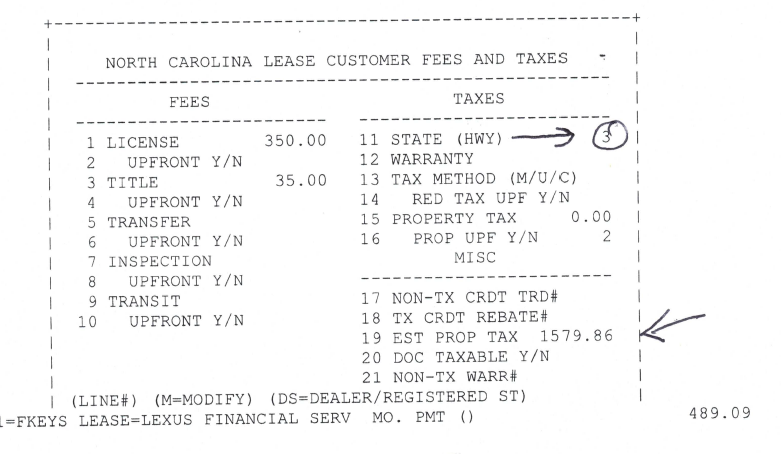

Property Tax When Leasing In Nc Ask The Hackrs Forum Leasehackr

Fairlease Lease A Car Online Best Truck Lease Deals 0 Down

/images/2022/02/08/woman_in_car.jpg)

How To Legally Avoid Paying Sales Tax On A Used Car Financebuzz

Yes You Can Sell A Leased Car Nerdwallet

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars

Is Buying A Car Tax Deductible Lendingtree

New Vehicle Special Offers At Land Rover San Diego Holman Automotive

What Parts Of Car Leases Are Negotiable

Sales Tax When Leasing A Car R Texas

Can I Move My Leased Car Out Of State Moving Com

Used Texas Premier Motors For Sale With Photos Cargurus

Best Chevrolet Silverado 1500 Lease Deals Specials Lease A Chevrolet Silverado 1500 With Edmunds

Sales Tax On Cars And Vehicles In Texas

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars